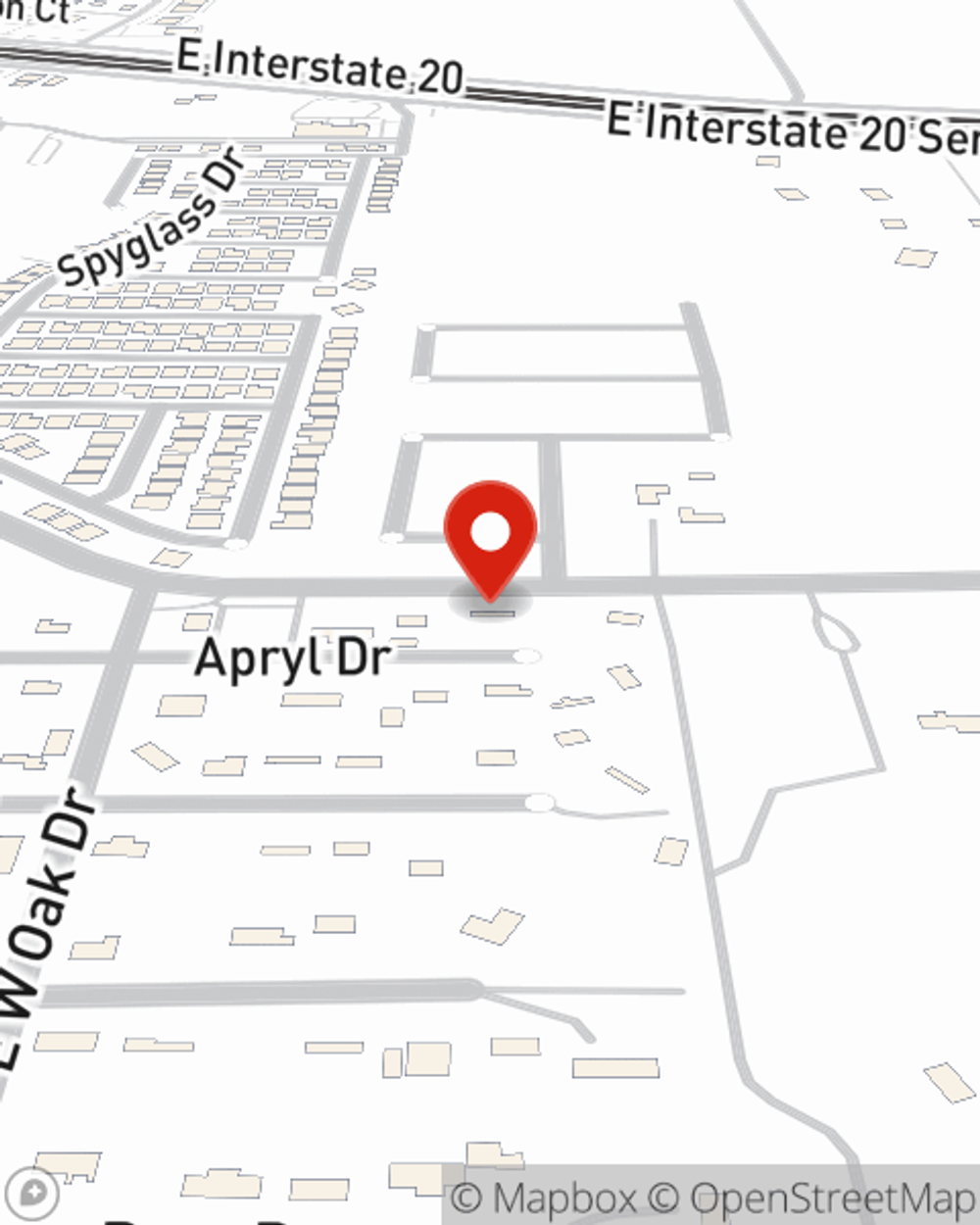

Business Insurance in and around Aledo

Calling all small business owners of Aledo!

Helping insure businesses can be the neighborly thing to do

Cost Effective Insurance For Your Business.

As a small business owner, you understand that sometimes the unpredictable is unavoidable. Unfortunately, sometimes mishaps like an employee getting hurt can happen on your business's property.

Calling all small business owners of Aledo!

Helping insure businesses can be the neighborly thing to do

Surprisingly Great Insurance

Being a business owner requires plenty of planning. Since even your brightest plans can't predict consumer demand or global catastrophes. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for uncertainty with a State Farm small business policy. Business insurance protects more than just your facility or shop.. It protects your hard work with coverage like extra liability and a surety or fidelity bond. Terrific coverage like this is why Aledo business owners choose State Farm insurance. State Farm agent Jason Needham can help design a policy for the level of coverage you have in mind. If troubles find you, Jason Needham can be there to help you file your claim and help your business life go right again.

So, take the responsible next step for your business and reach out to State Farm agent Jason Needham to explore your small business insurance options!

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Jason Needham

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".